The Aurum Gold Fund offers a 100% Asset Backed, Fully Secured Investment in the Gold Mining Industry. The Fund holds operational gold mining companies in East Africa which are already producing gold and own mining fields with proven deposits of the precious metal. Spot Gold price predictions remain bullish in the short and long term.

Companies require acceleration capital to boost production and capitalize on these favorable economic trends. The mines are pre-IPO and require acceleration capital in order to float on a major exchange. Shares are offered at significant discount to expected value as well as paying a distribution of 6% in the interim.

THE COMPANY

THE MARKET

Macro Economic Backdrop

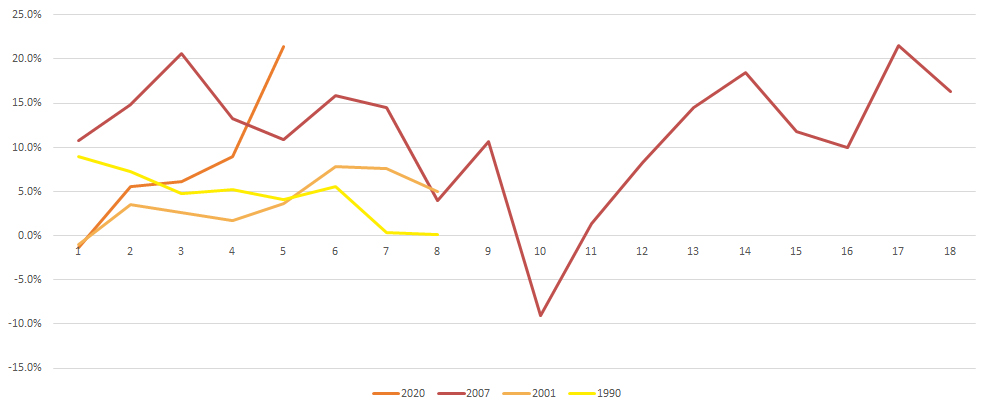

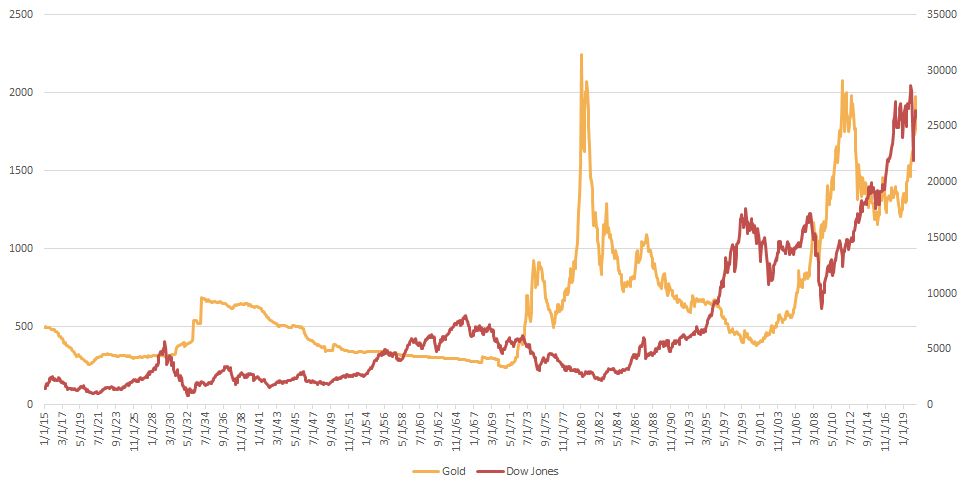

The Coronavirus Pandemic presents several serious macro-economic challenges in the short-medium term globally. Hence, Gold has been heralded in the 2020 as a key portfolio hedging strategy due to it resilience and in certain circumstances, negative correlation to adverse macro economic trends.

The Gold price in H1 2020 increased by 16.8% in US Dollar terms. With analysts predicting further gains for the commodity. As global macroeconomic uncertainty persists, gains in the Gold spot price are likely to be sustained. Gold mining stock offered on listed equity markets are attracting significant interest from large investors wishing to gain deeper exposure to the commodity.

THE TERMS

GBP, EUR, USD, ILS, SGD

Equity Ownership: Aurum Holdings IOM

Investment Secured Against Asset

£50m

End Q4 2020

6% p.a. (3% Semiannually)

£50,000

Precious Metal Mining

Africa

Annual

CONTACT US

Find Us:

12 Mount Havelock,

Douglas,

Isle of Man

IM1 2QG

Contact us:

info@aurum-holdings.co.uk